How was the investigation carried out?

-

Hassel Fallas

hassel.fallas@nacion.com

hassel.fallas@nacion.com

Editor, Data Intelligence Unit

Published on December 8, 2014

Dear Reader, thanks for your time. In this space we will tell you how this investigation on the prices of fuels in Costa Rica emerged and how we carried it out. It is to be published starting on December 8, 2014, and through next Saturday. This work, which involves reporting, creating and analyzing databases, shows among other things how the Public Service Regulatory Body included, in the formula to estimate the prices, a hidden subsidy which increases the cost of diesel and gasoline in order to benefit those of asphalt and gas.

In mid July, my colleague Mercedes Aguero and I published a story which showed the narrow margin the Government has to lower the prices of fuels. We were satisfied, but knew that the topic of the price of fuels allowed for much more than a two-page article. We discussed it and soon had a list of questions which demanded answers:

• What is the explanation for Costa Rica to have the highest prices per liter of gasoline and diesel in Central America?

• What political and regulatory decisions have led us to be the most expensive?

• Is the Costa Rica Petroleum Refinery (RECOPE in Spanish) efficient when buying fuels in the international market and in its operation?

• What is the destination of every colon we pay in taxes when we fill our tank?

• Do the fuel markets in the region have comparable conditions?

• Do Costa Ricans pay for fuels that are of better, equal, or worse quality than elsewhere in the Isthmus?

For five months, we engaged in the task of finding the evidence (documentary, digital, oral, and data) to produce the best-founded answer to those doubts. While investigating, as usual, new questions emerged./p>

In a conversation, a source commented that the prices of diesel and gasoline were altered by a cross subsidy. Mercedes remembered that, years before, another source had told her that something was not right regarding the change in the price formula which ARESEP had made in late 2008. We went to a third person, who knew the internal operations of the Regulatory Body, and he repeated the subsidy story.

The mandatory question was: How to prove the existence of that subsidy which is not visible in the formula to set the prices? Primero, analizamos el expediente ET-153-2008, which contains information on the process to change the formula. We also studied the arguments of the technical report which supported the new methodology. Later, we reviewed Resolution RRG-9233-2008, published in La Gaceta (the official journal), which gave the green light to the change in the estimate. Finally, we examined the public correspondence of the Regulator at the time and the appeals against the methodology submitted by RECOPE to ARESEP’s board of directors.

In that stage we obtained priceless evidence, but it was building a database what enabled us to understand how ARESEP included the cross subsidy in RECOPE´s cost formula and how, finally, that distortion was practically paid by the consumer of diesel and gasoline, the two most-sold fuels in Costa Rica.

We built the database manually, extracting all of the information which we deemed vital in the 59 price resolutions, both ordinary and extraordinary, issued by ARESEP starting in June 2009 and through September 2014. The documents are online, but in Word and PDF format.

We included only half of 2009, because previous resolutions lacked important data and clarity, something that was also admitted by Ingrid Araya, ARESEP´s Fuel Rate coordinator, in a later interview.

The formula. With that database, we were able to break down the components of the formula in order to establish how RECOPE’s operation costs (K factor) are included in the price for every liter of fuel. We made our own estimates to confirm the validity of those included by ARESEP in its resolutions.

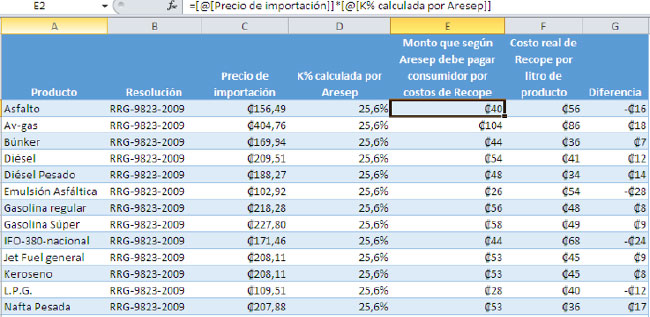

Thus we found that, even though RECOPE has defined how much it costs to place each product in its plants (a value which includes insurance, freight, storage, transference by pipeline, among others), ARESEP estimates them anew, applying to each the same percentage based on the import price. That listing is called k%.

To estimate K%, the regulator body multiplies the international purchase price of each liter by the projection of its total year sales. The result of those operations is divided into the income required by RECOPE to cover its costs.

Finally, in order to determine how much consumers should pay as RECOPE cost in each liter, K% is multiplied by the import price of each fuel. Thus, per product, an absolute amount is obtained again and it is different from RECOPE’s real costs, generating a subsidy which harms diesel and gasoline.

Example:

Step 1:

Step 2:

Step 3:

In order to facilitate the publication, we averaged, for each year, the amount for RECOPE’s costs that ARESEP charged consumers in each extraordinary price resolution.

Then, to define the amounts the consumer paid in excess or was undercharged, according to the type of fuel, we compared the costs ARESEP recalculated with RECOPE’s real ones. RECOPE’s real costs are acknowledged by the regulatory body in ordinary studies, but are changed in the extraordinary resolutions to set prices, through the application of its K% formula.

In order to find the amount consumers paid in excess or were undercharged from 2009 through 2013, the total sales of each fuel were multiplied by the costs assigned by ARESEP and also by RECOPE’s real costs. The result of the second multiplication was detracted from that of the first one.

Thus we established that in the last six years diesel consumers paid up to ¢73 billion in excess because of the subsidy, while gas consumers saved, at least, ¢33 billion.

For more information, explore this database or interact with the graphics and the timeline included.

TAX, SUBSIDY, AND RECOPE’S COSTS PREVENT BUYING CHEAP GASOLINE

Methodology: To create the price structure for gasoline in each Central American country, the weekly prices, in dollars per gallon, recorded by the Central American Fuel Cooperation Commission (CCHAC in Spanish) in 2013 were used. The amounts equaling the tax were also taken from the same organization.

The data from both listings were averaged in order to obtain one sole value per country for 2013 and were then divided into 3.78 to define the value per liter and its corresponding tax. To estimate the import price for each liter the official import figures and the bill paid for regular and super gasoline were obtained from the ministries of energy and mines, statistics institutions, central banks, regulatory bodies, and other responsible organizations of the sector in each Central American country.

Also recorded are the data from dealers and business chambers in order to come close to the margins of dealers and gas stations in nations where information is not wholly public, such as in Nicaragua. The local amounts were converted to dollars in order to ease the comparison.

Finally, for the application which compares the prices in Costa Rica with those from 160 nations around the world we used the prices compiled by the site www.globalpetrolprices.com. The information regarding per capita consumption by country was taken from the page of the US Energy Information Administration (EIA).

This report also includes the evolution of prices for regular gasoline and diesel from October 2010 through October 2014. To neutralize the sudden variations of prices, the estimate was made for their average quarterly value. From those prices, the effect of inflation was subtracted, in order to specify their real value and find out how much they increased or decreased in the time studied.